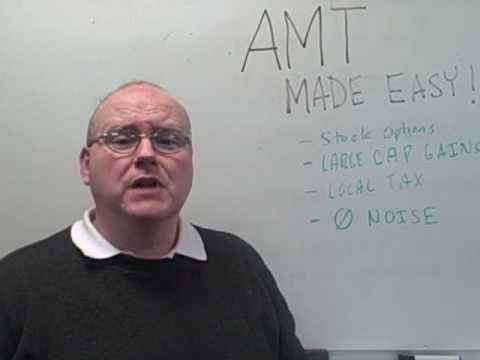

Hi, welcome to my wealth com. I'm Bob O'Brien, a senior instructor with the courses. Today's blog is about the alternative minimum tax (AMT) made easy. There has been a lot of talk over the last couple of years, maybe 10 years or so, about the AMT. It was legislation that was actually passed 40 years ago and was intended for the super wealthy who weren't paying any taxes at that time. It's a perfect example of how legislation passed decades ago can affect the future in unintended ways. What I do want to talk about are a couple of points to make sure that you're not blindsided by the AMT. Most people aren't, but there are some occasions when it can happen, and I want to point them out here. First, let's talk about stock options. If you have stock options, especially incentive stock options (ISOs), you need to do some planning. ISOs are subject to the AMT, unlike non-qualified stock options. This is where the confusion can come in. You may get hit with the AMT when exercising ISOs. It's important to work with a good program or a tax advisor to make sure you handle stock options properly. Another thing where people have gotten blindsided by the heavy AMT is large long-term capital gains. Although long-term capital gains are not subject to the AMT per se, it's a perfect example of how the tax system has many moving parts. Having a large long-term capital gain can push things around and make you subject to the AMT. You can read more about this in the blog and written blog on WMI welkom. Apart from stock options and capital gains, there are other things that can subject you to the AMT, such as property taxes, state income taxes (especially for coastal residents), and...

Award-winning PDF software

How to fill out 6251 Form: What You Should Know

Who is a U.S. Real Property Interest? — TurboT ax Jan 12, 2025 — Real property interest is a property that has real estate or other tangible personal property in it, such as land or buildings, or any portion of it, and uses real property or other tangible personal property used in running the business of the entity such as machinery, equipment, land, buildings, buildings, real or personal property or any other sort of tangible personal property or services. See our page on Real Property Interests: Forms to File with a Qualified Real Estate Investment Trust and Tax Related Transactions — TurboT ax What Are Qualified Real Property Investment Trusts? — The Advisor Sep 28, 2025 — If you have a qualified real estate investment trust, you are responsible for paying taxes on all net gains or losses from the trust. The net gains aren't subject to the AMT. But you may be required to pay the AMT. As a result, your net losses may become larger than your net gains. Taxes on Foreign Bank and Financial Accounts — QuickBooks Sep 2, 2025 — Foreign bank accounts are financial accounts of foreign institutions located outside the United States that are not operated as U.S. branches, subsidiaries, or financial partnerships. The income tax requirements of the Internal Revenue Code apply to all financial accounts held under foreign laws from which dividends, interest, or other income can be derived. U.S. citizens will pay U.S. tax on the income therefrom. Forms to File With a Foreign Financial Institution — IRS When you report income that is reported on Form 1099, you are required to make Part I of the Form 1099 report an itemized deduction for any expenses that are reported separately on Schedule A to Form 1040, for which the expenses are in excess of the deductions for Schedule A. For example, if you report a rent deduction on your Form 1099 and pay a landlord for the rental of a home, you will report the full amount of the rent deduction on your Schedule A. If, however, your total income from your rental property is reported on your Form 1099, you are only required to report a separate rent deduction, if there is more than a 75 deduction limit (the rental deduction limit is 50.00 for a single person or 300.00 for a couple, and the 300.00 limit will be reduced if more than one deduction was taken for the same day).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 6251, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 6251 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 6251 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 6251 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill out Form 6251